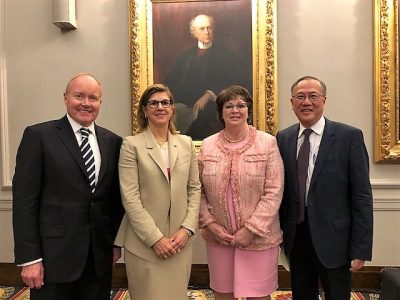

It was an honour for the IIAC to host Bank of Canada Deputy Governor Lynn Patterson at a luncheon in Toronto today. She spoke about interest-rate benchmarks and the work underway in Canada and globally to strengthen them.

Interest rate benchmark reform is important to our clients in the financial sector and to the safety and stability of global financial markets. Millions of financial contracts valued in the trillions of dollars rest on these reference rates and affect many of our clients that do business across nearly all asset classes, including derivatives, bonds, loans and other financial instruments. Robust benchmarks are also important because they facilitate the standardization of financial contracts, leading to lower transaction costs and enhanced market liquidity.

If a new risk-free term benchmark is developed, market adoption will be critical. For firms in our industry, transitioning to new benchmarks means adapting trading and risk systems and back-office processes.

You can read the Deputy Governor’s speech or watch a video webcasts of the speech.